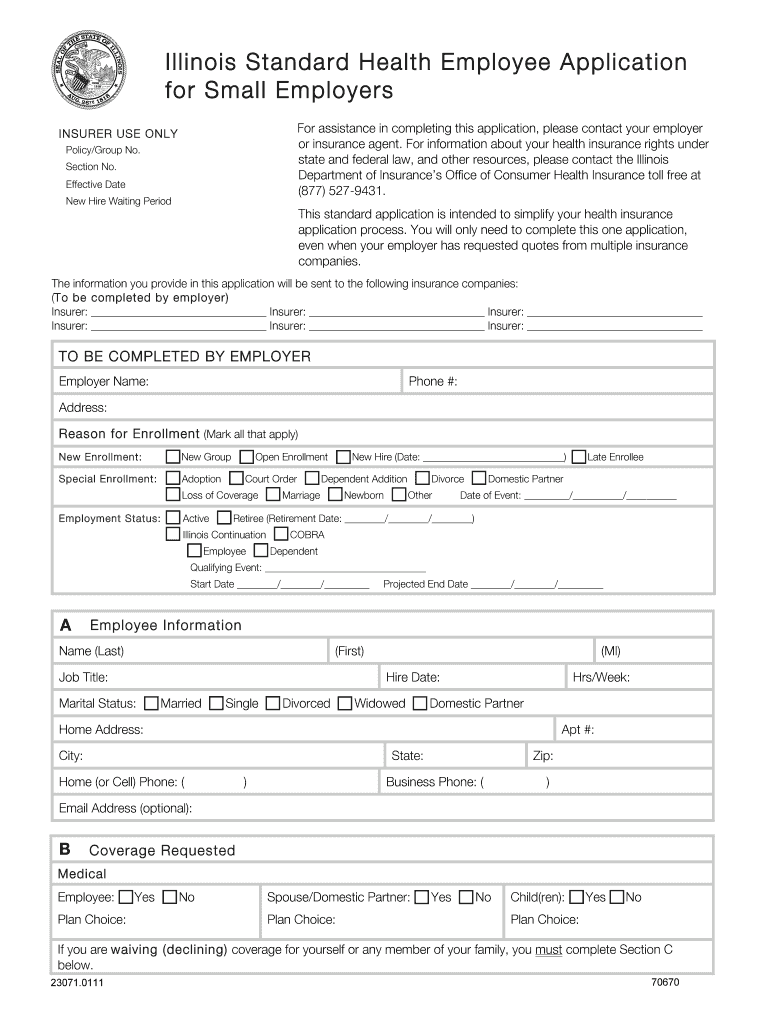

The Greatest Guide To "Navigating the Complexities of Group Health Insurance: Tips for Small Business Owners"

Comparing Different Types of Group Health Insurance Plans for Small Businesses

When it comes to offering health insurance perks for their workers, small organizations often encounter numerous problem. One of the very most essential selections they have to create is selecting the correct group health insurance planning. With a vast range of choices available, it can easily be mind-boggling to get through through the numerous policies and determine which one is the ideal match for their company's requirements.

To assist little business proprietors produce an informed selection, allow's review different styles of group wellness insurance policy program frequently provided in the market.

1. Health Maintenance Organization (HMO) Program:

HMO strategy are recognized for their thorough protection and cost-effectiveness. These program usually call for employees to decide on a major treatment medical doctor (PCP) who teams up all their medical care needs. Recommendations from PCPs are required for observing specialists or obtaining specialized treatments. HMO plans usually possess lower monthly superiors but need members to remain within a system of healthcare suppliers.

2. Preferred Provider Organization (PPO) Plans:

PPO program offer additional flexibility contrasted to HMOs through allowing employees to go to any type of healthcare provider without calling for recommendations from a major care medical doctor. While PPOs possess much higher regular monthly costs than HMOs, they provide higher freedom in choosing medical professionals and healthcare facilities outside the system if required. PPOs also deal with a section of out-of-network expenditures, creating them desirable for those who really want more control over their medical care decisions.

3. Exclusive Provider Organization (EPO) Program:

EPO strategy strike a balance between HMOs and PPOs through giving cost-effective possibilities with some versatility in provider option. These plans do not require recommendations like HMOs but still preserve a network-based design where employees have to acquire treatment coming from in-network carriers unless it's an emergency situation scenario or pre-approved by the insurance provider.

4. Factor of Service (POS) Planning:

POS planning combine aspects coming from both HMO and PPO designs. More Details in POS program are required to decide on a major care physician, similar to HMOs. However, they possess the choice to see experts outside of the network without a recommendation, like PPOs. POS planning normally possess greater monthly superiors but provide greater versatility in carrier choice.

5. High Deductible Health Plans (HDHPs) along with Health Savings Accounts (HSAs):

HDHPs are becoming more and more prominent due to their lesser month-to-month fees and the capability to combine them with tax-advantaged HSAs. These planning call for workers to pay for higher out-of-pocket price until they arrive at a insurance deductible limit before insurance coverage coverage kicks in. HSAs enable employees to set aside pre-tax dollars for eligible health care expenditures, delivering added cost savings opportunities.

6. Self-Insured Planning:

Self-insured or self-funded plans are those where companies suppose the financial danger of offering healthcare benefits straight instead than buying insurance coverage from an insurance provider. Companies pay for for case out-of-pocket and may acquire stop-loss insurance to defend versus tragic insurance claim. Self-insured planning supply more control over program layout and expense administration but likewise require cautious danger assessment and monetary stability.

Each type of group health insurance policy planning has actually its very own advantages and drawbacks, so it's crucial for tiny company proprietors to carefully analyze their organization's requirements and get in touch with with a advantages specialist or insurance policy broker just before helping make a choice.

In final thought, choosing the appropriate team health and wellness insurance coverage strategy is an essential selection that can easily dramatically influence tiny companies and their workers' well-being. By matching up different types of team health and wellness insurance plans such as HMOs, PPOs, EPOs, POS planning, HDHPs along with HSAs, and self-insured choices, little business managers may locate the finest fit for their organization's financial constraints and healthcare necessities.

Keep in mind that each company is unique; for that reason, it's important to take into consideration factors such as worker demographics, budget constraints, preferred network providers, insurance coverage demands, and long-term sustainability. Taking the opportunity to meticulously examine these variables will certainly aid small companies help make an informed choice that gain both their employees and their base series.